Financial Literacy For College Students: 5 Important Bases To Cover

We recommend helpful products in our articles. Read our full disclosure here. The content on this website is not intended to be a substitute for professional advice, diagnosis, or treatment.

Is financial literacy for college students important?

Oh yes!

With great educational opportunities also come important financial commitments.

That said, as a college student, you mustn’t just understand the academic basics but be financially literate as well.

In this article, we explore how college students can thrive in personal finance, from understanding financial education costs and handling student debts to taking control of credit card use and saving money for later.

By arming yourself with knowledge now, you’ll have a stronger foundation for future success down the road – so let’s dive right into financial literacy for college students!

Paying the Price – College Tuition & Costs

College is a rare chance to change your future for the better – but it doesn’t come cheap.

Every student needs an understanding of all the costs involved if they want a clear picture of their academic and personal finance for college students.

Not just tuition fees either – we’re talking textbooks, wherever you’ll live, what goes in your stomach, transportation…and these are just some of the necessities to consider.

Finding the perfect college within your budget can be a tedious and time-consuming process.

Not to mention, some universities may cost an arm and a leg compared to others!

In-state students at public schools can often get away with paying less in tuition compared to out-of-state learners, so that’s always a plus!

Bear in mind there could also be certain extra fees for specific classes like laboratories or technology software.

All this shopping around means you should take your time when researching different institutions – it pays off in the long run!

Making it through college is no simple task, and the expenses that come with it add up faster than you’d think.

Apart from rent or dorm fees, there’s power and internet to think about too – not to mention food shopping, meal prep costs…the list goes on.

Don’t forget the transportation costs if you commute back home or have to get between your housing and uni somehow.

It all adds up – really quickly!

Financing Postsecondary Education

It can seem like a real challenge to figure out how to afford college, but there’s good news.

There’re plenty of ways to cut down the cost of higher ed – scholarships, grants, and work-study programs are all great options.

Plus, don’t forget that mom and dad can help too; even if they haven’t saved enough money for your schooling, kindly asking is not harmful!

Scholarships should be your first step in figuring out how to pay for school.

With scholarships, you don’t need to stress over repayments – and you can find them from a whole array of public and private sources.

Do you want to up the chances of securing funding?

Research and shoot off applications for all the scholarships available!

Here’s a trick: You can do the research at The Times of Israel regarding top essay services and learn from those texts about where to find the most suitable ones.

It’s worth considering grants as well; they’re typically awarded to those in need and don’t have to be paid back.

Federal grants and each school have its programs available, so definitely look into it.

If you want the full scoop on what kind of financial aid you qualify for, go ahead and consider filling out a FAFSA (Free Application for Federal Student Aid).

Managing Educational Loans for Learners

Financial literacy for college students should also cover the unpleasant part: student debt and loans.

College students should be clued up when it comes to recognizing the ins and outs of student loans.

It’s no secret that taking out a loan is a regular part of college life these days – but being unaware of the knock-on effects (both short and long-term) would leave any student in strife.

Therefore, don’t ignore the costs: savvy borrowing can help prepare you for a bright student financial literacy future, and prevent overpayment.

Knowing the ins and outs of applying for a student loan is key.

It pays off to be conscious of several things:

- Interest rate;

- Your repayment options;

- Any additional fees or penalties that may come along with it – because you don’t want those unexpected fees to blindside you later on!

To make sure your borrowing won’t exceed what you need, estimate your future payments as well as the overall cost of what you’ll owe after graduation.

By doing this, chances are good you can avoid taking on too much debt.

Credit Cards – Powering Up Your Purchases Smartly

As a college student, getting the grasp of credit cards is important and it’s all about mastering money management.

Remember the quote by Jim Rohn that says: “Money is usually attracted, not pursued.”

Using credit cards properly can lead to having a good credit history and paying for things you need but caution is warranted!

Don’t blow it – if overlooked, these plastic wonders, though they seem handy right off the bat, could quickly send you spiraling down into debt.

Acquire knowledge on how to use them wisely as a young adult – your pocketbook will thank you in the long run.

Struggling to grasp interest rates and how they work on your credit card?

Get a consultation with your credit card provider and ask every question you have until it’s all clear.

Your debt can quickly balloon if you don’t pay off the total amount every month, so it’s best practice to at least keep up with minimum payments.

Keep in mind that every little bit adds up – while a few dollars here or there may not seem like much, those amounts can snowball until suddenly you’re overwhelmed by what you owe.

It pays (literally!) to know about these kinds of pitfalls before getting into costly financial literacy trouble.

Minimizing Spend & Saving Money

We get it; money coming in means you want to spend it!

But if you develop the habit of savings early on, your future self will thank you.

College is a great time to kickstart smart habits — while part of that includes learning how to manage finances properly or using those best assignment writers for school projects and maximizing the potential you can get from their texts.

Don’t wait ’til you’re knee-deep in debt before feeling the urgency— start saving money as a student.

It’s not easy, but if possible, it pays off now and down the road!

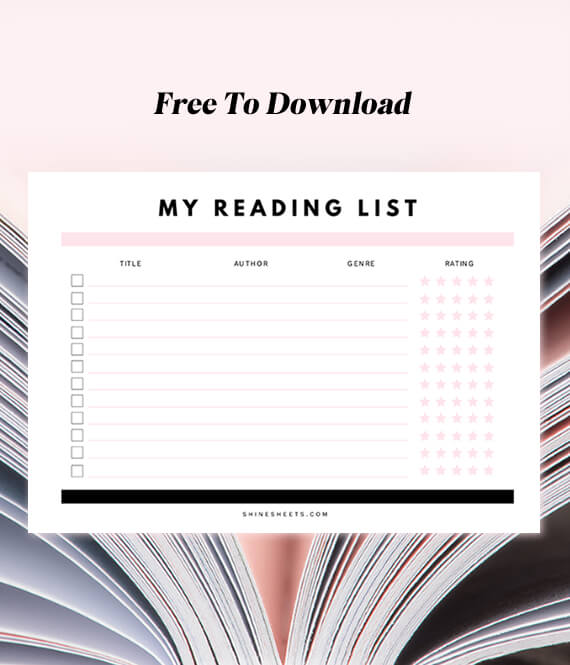

Also, creating and adhering to a budget is a priority of financial literacy for college students.

Deduct an established amount from your salary or monthly allowance for fixed costs such as shelter, nourishment, and transport.

To save cash and steer clear of debt, it is essential to be mindful of how much extra cash you possess at any given moment.

Financial Literacy For College Students: Conclusion

In the end, students must learn money management to avoid financial stress and focus on their studies.

Looking over college costs and studying payment opportunities can help avoid debt or financial difficulties.

Besides, knowing loan repayments could come in handy too!

Credit cards offer convenience and also bring with them the chance of being mishandled, so be aware!

Additionally, saving money during your time at university – and beyond – is a skill that will prove fruitful all your life.

Thus, to secure financial stability both during university days and afterward, brushing up on financial literacy for college students should be prioritized.

Take some extra time out of your day to familiarize yourself with everything related to finance – eyeballing every detail is key for making wise decisions.

We hoped this overview of financial literacy for college students was beneficial.

Scroll down for more helpful content below.

"We love to research problems, examine studies, analyze solutions, and share with you ideas that make life healthier. You can learn about us and our editorial standards here. Have suggestions or feedback to share? Send us a message!."

Leave a Comment